Perhaps the most important part of trading (besides of strategies) is risk management. Usually, it determines the whole profits or losses of a trading session. Here in IronTrade, we try to remind our traders about this all the time, but still, some people do not follow this advice and waste all their deposits irrationally.

So, what are the actions that a trader could perform in order to find a balance between risk and profits? Now we will speak about five things that will get you to more responsible and efficient trading.

1. Pick your money management style:

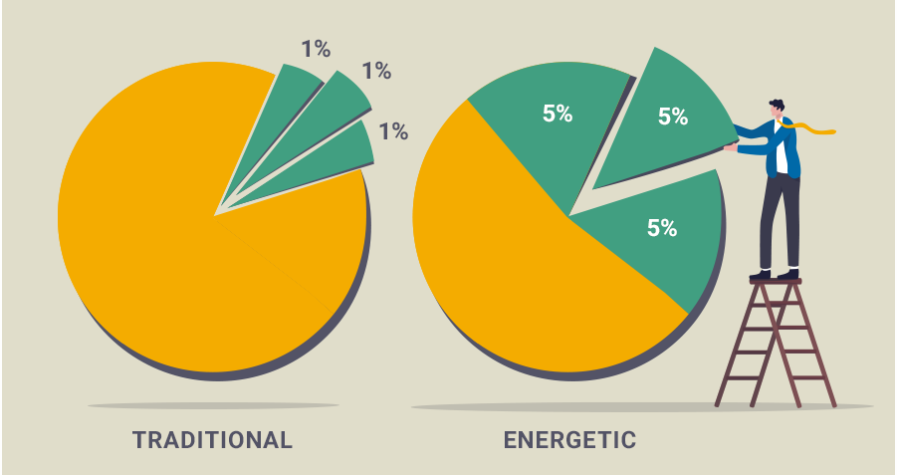

Traditional, for cautious newbie traders, and energetic, for those who already traded before. It does not matter which one you choose and whether it matches your experience. The most critical part is to stay true to it and follow its principles.

If your choice is traditional, then you should not spend more than 1% of your account balance in one trade and no more than 3% of your balance at a time. It means that you can open only three trades at once, and the total investment amount should not be more than 3% of your account balance. Generally, newbies prefer this method as it requires less money for trading. For instance, if your total balance is 100$, you can use only 3% of it – 3$.

If you choose the energetic trading method, you can spend up to 5% in one trade and use not more than 15% of your total account balance. It means that your maximum losses for one trade will be no more than 5% of your capital. Only experienced traders should use this method—those who already have some proved working strategies and favorite assets.

2. Don’t stick to one asset (at least at the beginning)

Sometimes markets are very unpredictable, and assets fluctuate with skyrocket speed within a short range. We recommend trading with assets when they remain in a more predictable state. Choose 5-6 of them, preferably different: Forex pairs, Crypto and Metals. On IronTrade, you can find all of them and diversify your portfolio to avoid unmanageable losses and mitigate risks.

3. Find the best time to open trades

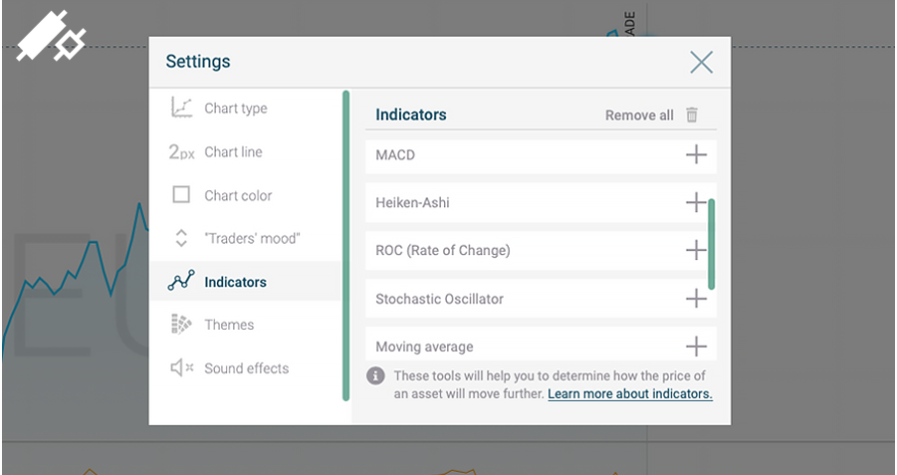

Unfortunately, the moment of absolute certainty never arrives, but you can raise your chances to find the right entry point. Firstly, start with technical indicators. IronTrade has a great variety of them: MACD, RSI, Rate of Change, Alligator, and many others. Don’t be afraid of these words. Try to learn how to use them, and you will send us a Thank you note afterward 🙂 It helps a lot.

When you open trades based on technical data and news, it gives much more outcome when you do this based on pure intuition.

4. Set up trading limits

When you decide to sit down and trade, set up a timer that will inform you about the time to stop. Or you can determine a number of trades that you can execute per day. Or you can set up a maximum number of failed trades in a row.

Generally, it can be anything that will prevent you from exhausting and impulsive actions. Breaks are essential to avoid harmful experiences that anyone can do while trading. Also, during the break, you can clear your head, release your tension, and collect your thoughts for future trading.

5. Investigate your mistakes

According to our internal research, more than 90% of traders do not work on their performance and do not check their trades’ history. We can conclude that they do not understand their mistakes and can not do even basic corrections of their errors. On IronTrade, you can check the complete history of your trades from the very beginning. It includes all the information: when it was done, how much was invested, and the result. You can be more effective if you check results from time to time and think about what exactly helped you make or lose money. Otherwise, you will just repeat again and again some wrong trading patterns.

2 Comments

Diego

11.05.2021, 19:03Thank you for the tips!

Brian

11.05.2021, 20:34Good tips! thanks!