Many novice traders think that Forex is a confusing and challenging thing. However, if you learn the main principles of its work, it does not seem so bad. It is indeed a big subject, but understanding the basic concepts may allow you to start trading more efficiently from the very first day.

This article is a guide for beginners who have just started to learn about Forex trading. Here we will learn what Forex means, how to read charts and a brief explanation of analytic tools presented at IronTrade.

So, what is Forex?

Let’s start with the fundamental things to continue with trading. What is Forex, and what is it used for?

This word is derived from two other words: “FOReign” and “EXchange“. The foreign exchange market is the biggest decentralized market in the world. In other words, it is not located in one place. It is a network of economic relations between banks, brokers, and traders who want to buy or sell foreign currencies. It was established as a response to developing national currency markets and their interaction.

On this market, you will not see specific prices for some particular currency. You will see the relation of one currency against another. Or, in other words, how much does one currency cost in relation to another one. That’s why the prices on Forex are always shown in pairs: EUR/USD, USD/JPY, etc.

How to read charts?

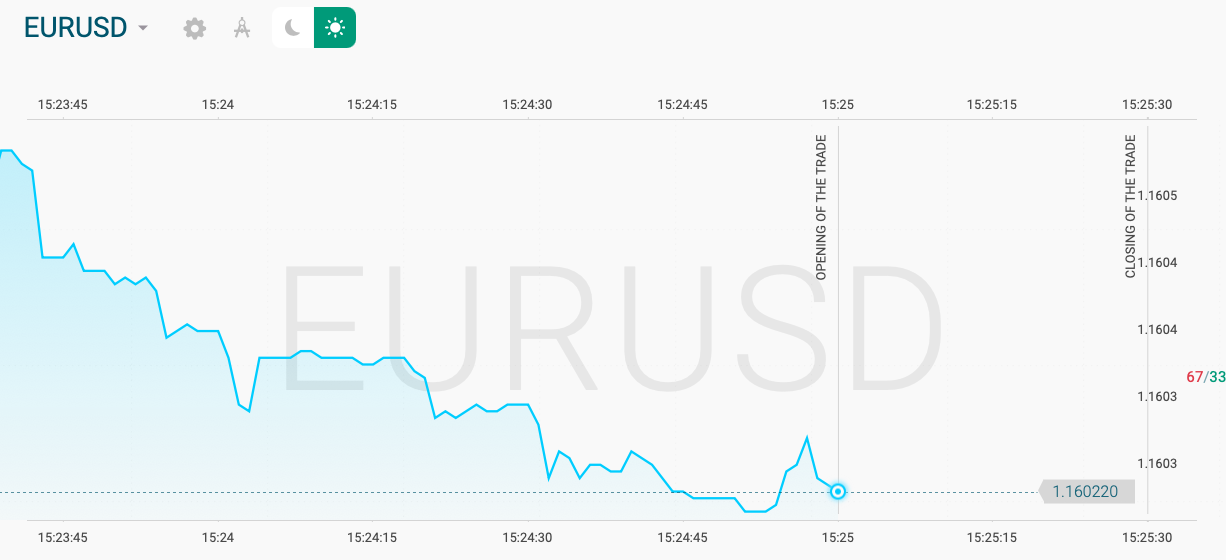

The exchange rate is always shown in two currencies. The first currency is called the base, and the second is the quote. The base currency is always calculated in units of the quote currency. For example, if you see the exchange rate for EUR/USD 1.15, it means that 1 Euro costs 1.15 US Dollars. If the chart rises, then it means that the price of EUR is going up against USD. And vice versa, if the price decreases, it means that the price of USD is going up against EUR.

All currencies on the market are divided into major and exotic. Major currencies are the currencies of the most developed countries globally, such as EUR, USD, AUD, CHF, CAD, GBP, etc. As for exotic, they are the currencies of minor (in terms of economy) countries, such as TRY, ZAR, etc.

Contracts

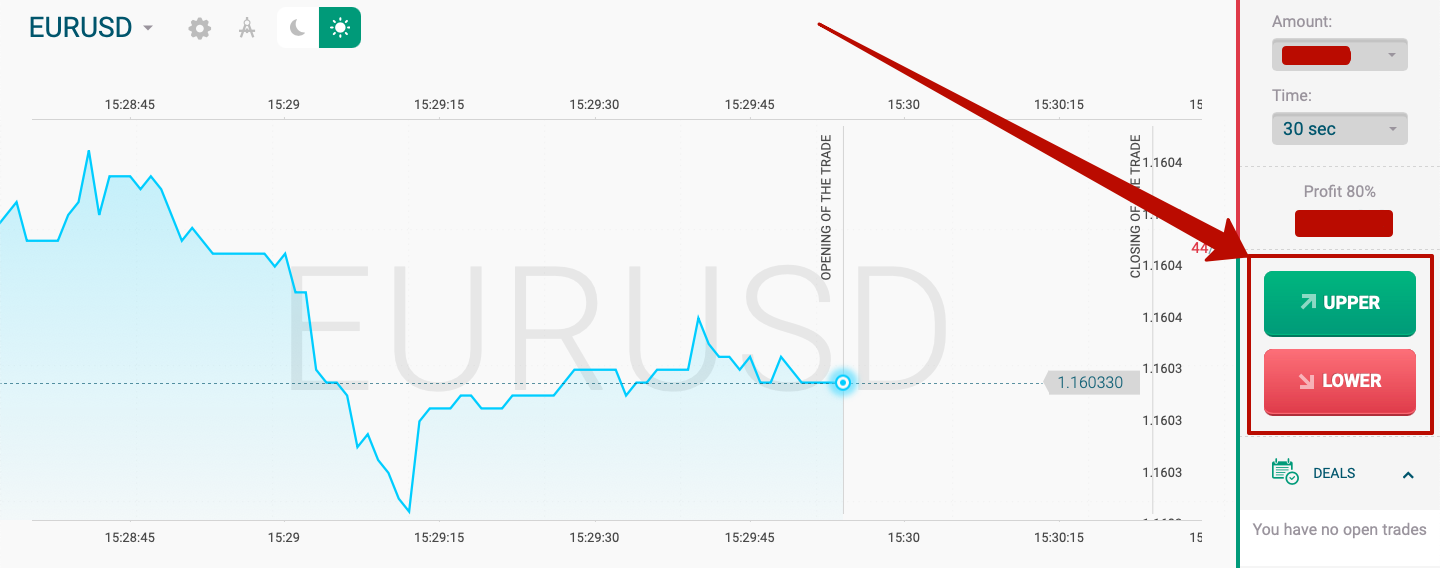

On IronTrade, all currency pairs are traded as contracts. It means that you do not buy or sell currencies but trade on the difference between the current value and the value at the end of the contract (expiration time). You can set various expiration times and the direction (up or down) of your contract. If your guess is correct at the end of the contract, then you get income.

Analysis instruments

When you open a trade on IronTrade, you guess where the price will go: up or down. To make correct predictions, you need to learn how to analyze the chart effectively.

There are a vast majority of trading tools and instruments aimed for analysis. If you want to be an experienced trader, you should learn about indicators and other graphic tools available on IronTrade.

It will take some time, but if you study hard, the income will be not long in coming. You can always practice for free by using a demo account. It is free because you make trades with virtual money using the same real charts. So, you can try to predict without investing real money and implement strong risk management from the very beginning. Try it right now on IronTrade!