Since 2021 has already begun, it is high time to look for new trading approaches. Definitely, it would help if you thought about different trading factors beforehand—for example, seasonal changes that may affect currency rates. I’ve gathered some critical factors that you might want to check before picking currencies to trade and planning your trading strategy for the near future.

I. SEASONS

The Winter months of December, January, and February are generally considered as the most flourishing time of the year, while autumn is the poorest in performance. All industries are affected by seasonal changes, supply, and demand things. When you realize this and understand what happens in different parts of the world at particular times, you will be prepared for “sudden” fluctuations better.

II. NEW YEAR RAISE

By the New Year Raise, we call a seasonal growth in the stock prices in January. It happens because traders tend to purchase more stocks at the beginning of the New Year and after December’s decrease. This drop is usually caused by massive sell-offs connected with tax-loss harvesting. Finally, a further rise in January is connected with pure psychology when everyone plans their strategies and purchases stocks at the beginning of the year.

Keep in mind that it’s not only you who are aware of all these. Many traders know this stuff and plan their trades accordingly. So, sometimes this New Year Raise is fully neutralized by them.

III. COVID VACCINATION

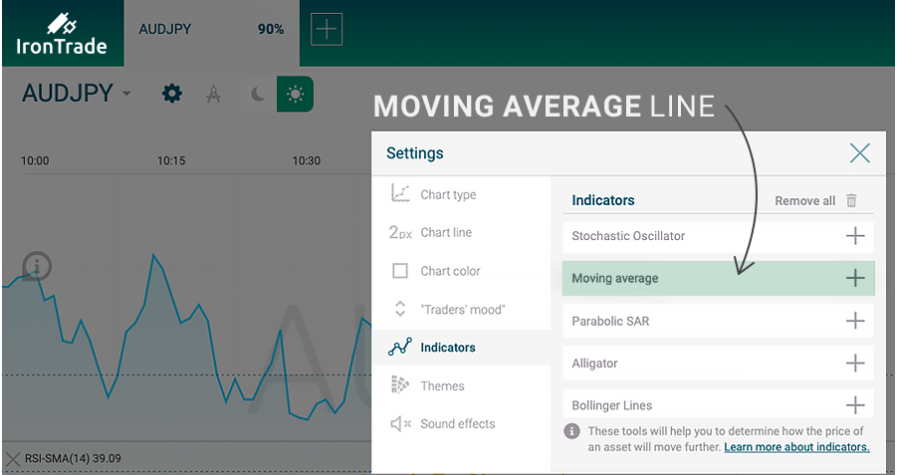

The covid vaccination has already begun (and even finished) in developed countries, which will bring the end of uncertainty and damages for the economy. It is still unclear what to expect in the nearby months, but the economists hope that 2021 will be a good year for the economic recovery. We already can notice its effects in comparison with the previous year. It is vital to estimate the prior performance of a chosen asset and make your predictions in accordance with your risk management strategy. Fortunately, IronTrade includes some easy technical analysis tools that you can use to control risk. The most popular is comparing an asset price to its moving average. Easy, yet effective if properly administered.