Average True Range (or ATR) is a simple indicator available for everyone on IronTrade. It acts as a measure of volatility and is one of the most widely spread technical indicators traders use. Therefore, it is essential for a lot of trading strategies.

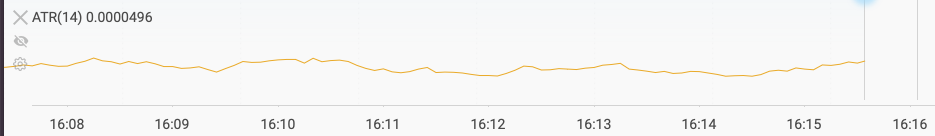

That’s how it looks like on IronTrade

How to use ATR

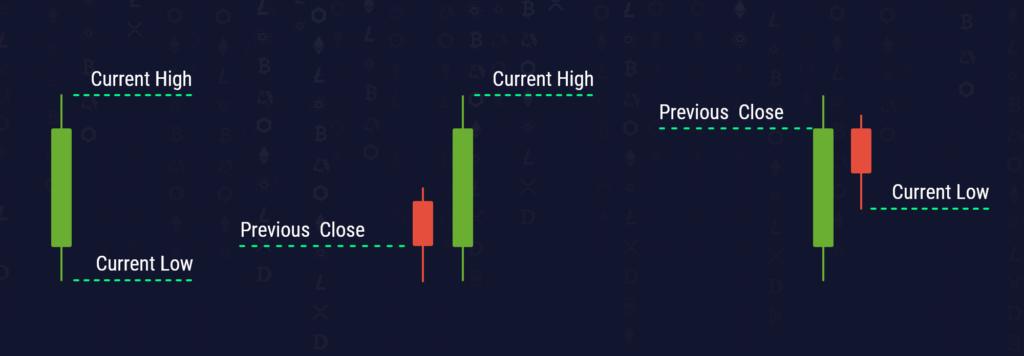

All currencies on the Forex market constantly fluctuate. Some currencies more, some less. But anyway, the volatility helps traders make money and brings trading opportunities. The idea is to identify the direction of a trend and understand if it is already started or is just about to start. Moreover, for some strategies, the direction of a trend is not important if the volatility is high. There are numerous ways to estimate market volatility, and ATR is one of them. Let’s take a look at the true range first. The true range is the greatest of the following:

1. The highest price (within a recent range) is less than the current low

2. The highest price (within a recent range) is less than the previous close price

3. The lowest price (within a recent range) is less than the previous close price.

It is essential to take absolute values for the last two points to guarantee positive numbers.

Take a look at the picture below to understand it better:

The true range is the greatest of these three values

ATR is a moving average of the true ranges mentioned above. By default, on IronTrade is used a 14-period moving average. Only one line represents the indicator. When volatility is high, the ATR line will go higher. Otherwise, the line will drop to the bottom when the market is stable.

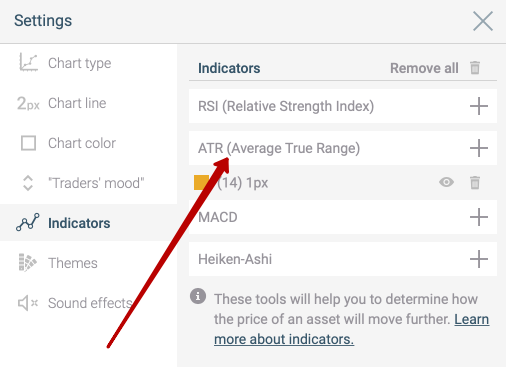

How to set up ATR?

To turn on the ATR indicator on IronTrade, click the gear icon on the chart, go to Indicators, choose ATR and click Apply. The indicator will appear below the price chart.

How to use ATR in trading

Trades can use the indicator to determine optimal entry and exit points. Periods of low volatility followed by periods of high volatility when the market is unstable. It creates considerable trading opportunities. When you know when the low volatility period is about to end, you can expect a sharp rise and fall soon.

The longer period you set up for ATR, the more accurate it becomes, but it shows significantly fewer trading signals. Conversely, the shorter period you set up for ATR, the more signals you will receive, but they may be false or at least not so accurate.

IMPORTANT: ATR uses absolute values instead of percentage change! Therefore, values for different assets and even the same asset on different timeframes cannot be adequately compared.

Finally

The Average True Range is an indicator to track volatility. It is not aimed at predicting the direction of a trend. So, it is a useful tool with great potential when combined with any trend-following indicator! Try it on IronTrade! Good luck!