Market trading has become very popular these days because of increased market volatility and the simplicity of access to trades for anybody. However, even with this easy entrance to the market, most traders have varying degrees of success.

Here in IronTrade, we have recognized specific patterns that distinguish profitable traders from their not-so-lucky colleagues. Let’s start with one of the most repeated mistakes that drive traders to losses:

HUMAN FACTOR

The periods on financial markets change drastically from stability to uncertainty. Even though some traders are pretty good at identifying trends and market directions, their poor money management ruins their success. The main issue here is that traders make little money when they are right and lose much more when they are wrong. Let’s try to understand why it happens.

HOW TO MAKE WEIGHTED DECISIONS

It is normal that Humans make illogical decisions (ALL Humans, not only IronTrade traders:). And now, I will describe the thoughtful and straightforward thing to illustrate a typical shortfall. Let’s imagine that I offer you to play heads or tails with a coin: I ask you about the result of a flip and if your prediction is correct, you get 100$. If not – 0$. Also, I give you another option to receive 40$ no matter the result. Which option would you prefer?

| Option | Chance | Possible reward |

|---|---|---|

| Option 1 | 50% chance that you get 100$ 50% chance that you get 0 |

50$ |

| Option 2 | Guaranteed 40$ | 40$ |

If we think logically, option 1 is good from a mathematical point of view because you can expect to make 50$ and have increased profits. However, option 2 is not bad as well because you have no risk at all for receiving smaller profits. So, we are not surprised if most of you would choose option 2. When it comes to profits, people tend to avoid risks and take the guaranteed gain. But what about potential losses?

Let’s turn over our experiment vice versa – we play on loss. We flip the same coin, and I offer you the same likelihood of a 100$ and 0$ loss in option 1 and a guaranteed loss of 40$ in option 2. Which one would you choose now?

In this case, option 2 decreases losses and thus is the logical option. However, similar experiments have proved that the majority of people would prefer option 1. When it comes to losses, we start to seek risks, but most would avoid risks when it comes to profits.

This experiment clearly shows natural human behavior in decision-making. It helps to explain one of the most typical mistakes in trading:

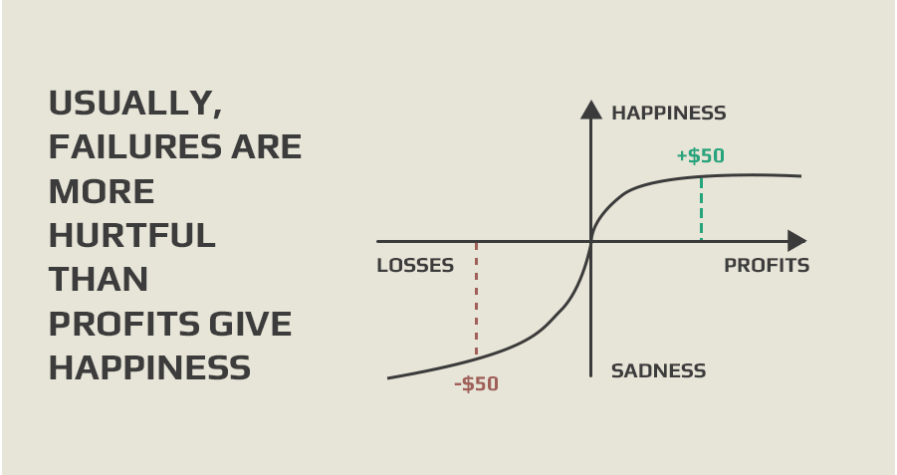

LOSSES CAUSE MUCH MORE PAIN THAN PROFITS GIVE HAPPINESS

And the main idea here is simple: the majority of people make decisions based on their attitude towards gains or losses. It is basic rationalism that a person makes decisions based on his desire to maximize profits and minimize losses.

We have to work on our emotions (past and present) and act rationally with the same passion as we try to make our trades profitable. In other words, if our goal is to make the most of possible profits, then 50$ winnings would be completely equal to a 50$ loss.

This picture illustrates how people might rank their happiness and sadness derived from profits and failures.

Usually, failures are more hurtful than profits give happiness:

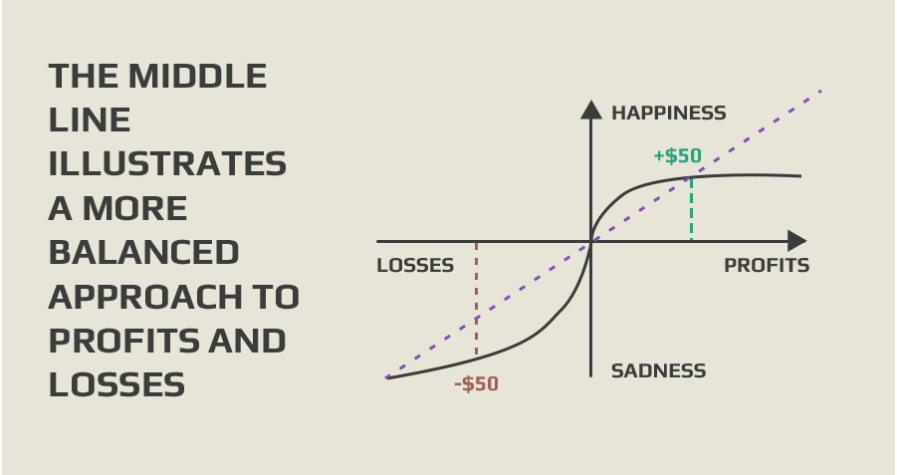

And the next picture illustrates a balanced approach to everything.

The middle line illustrates a more balanced approach to profits and losses:

We can conclude that a higher percentage of winnings should not be your primary goal.

What is more important is to find trades that give you an asymmetric form of risk. Fortunately, on IronTrade, you can check the history of trades for the recent period, add Moving Average and other indicators to the chart, etc. All these help to make the right decision.

It means that your main goal should be to find a solid and well-balanced ratio of risk and rewards, which indicates how much you have at risk versus how much you can gain.

For example, let’s imagine that your predictions are correct 50% of the time. Then your profits and losses ratio should be at least 1:1.

To make the things in your favor, you need to aim for a higher reward ratio (for example, 1.5:1).

Many traders at IronTrade are obsessed with a high-profit percentage. And it is quite understandable – nobody likes to lose. BUT, just admit that losses are part of your trading. You can not be right 100% of the time. Losing is normal – stay with this.

According to internal IronTrade studies, the optimal trading style is when you win around 40% of your trades with a 2:1 Risk-Reward ratio, i.e., risking 2 times more often. If you decide to win more often by risking less (let’s say win 60% of the time with a 1:2 Risk-Reward ratio), then, of course, you will feel better. But when you stop getting profits, it will lead you to disappointment. When you feel disappointed, it certainly will not help you and lead to further mistakes.

What do you prefer? Become a trader who has a positive account balance but loses more than wins? Or the trader who has a negative balance but wins more often?

We are not robots, and sometimes we should cope with our natural feelings. When you start to use a trading plan with an optimal risk and reward ratio, the next task is to follow this plan. Your emotions can easily prevail over you and make you hold on to losses or take profits early. You must get rid of your emotions when trading and avoid this natural tendency.

To sum it up, we can conclude that losing is a part of trading and is totally normal. Don’t give up and make sure you can control yourself, set up some limits, and try to achieve a suitable risk and reward ratio when planning out trades. Good luck.

What's your reaction?

Happy0

Lol0

Wow0

Wtf0

Sad0

Angry0

Rip0